Last week, the National Association of Real Estate Editors (NAREE) held their 52nd Annual Journalism Conference in Las Vegas, NV. Among the many highly anticipated sessions was one called “Top Ten Issues Affecting Real Estate™,” given by Joseph Nahas, Jr., Chair of the Counselors of Real Estate & Senior Vice President of Equus Capital Partners.

The Counselors of Real Estate (CRE) “is an international organization of high profile property professionals which include principals of prominent real estate, financial, legal, and accounting firms as well as recognized leaders of government and academia.”

Their annual “top 10” list spans any and all issues that could have an impact on the real estate market. This year, the list was broken up into “Current” and “Long-Term Issues.”

Today we’re going to focus on three of the five “Current” issues with a brief explanation of their impacts on the housing market today!

E-Commerce & Logistics

With promises of 2-day shipping no matter where you live, we are benefiting more now than ever before from the speed and ease-of-use of online retailers like Amazon. These e-retailers haven’t changed whether or not we buy certain items, but rather HOW we buy them!

Many traditional malls or big-box stores are being repurposed as warehouses or distribution centers for online retailers so that they can get their products out faster.

A Look to the Future: “Developers who are including experiences into their locations are the ones who will succeed. It’s about the experience and gaining something over just going to buy a product.”

Generational Change & Demographics

By now we’ve all heard that the millennial generation is the largest yet, just by sheer volume. The largest group of millennials turns 30 years-old in 2020. The average first-time homebuying age is between 30 and 32, depending on marital status. Real estate professionals will be inundated with more and more buyers as the years roll on. Nahas commented on this in his presentation, saying that,

“Too many developers have become dependent on making decisions based on baby boomer’s preferences.

The 75 million millennials are coming, and they will influence real estate and commerce even faster than the baby boomers in the 50s and 60s.”

Interest Rates & the Economy

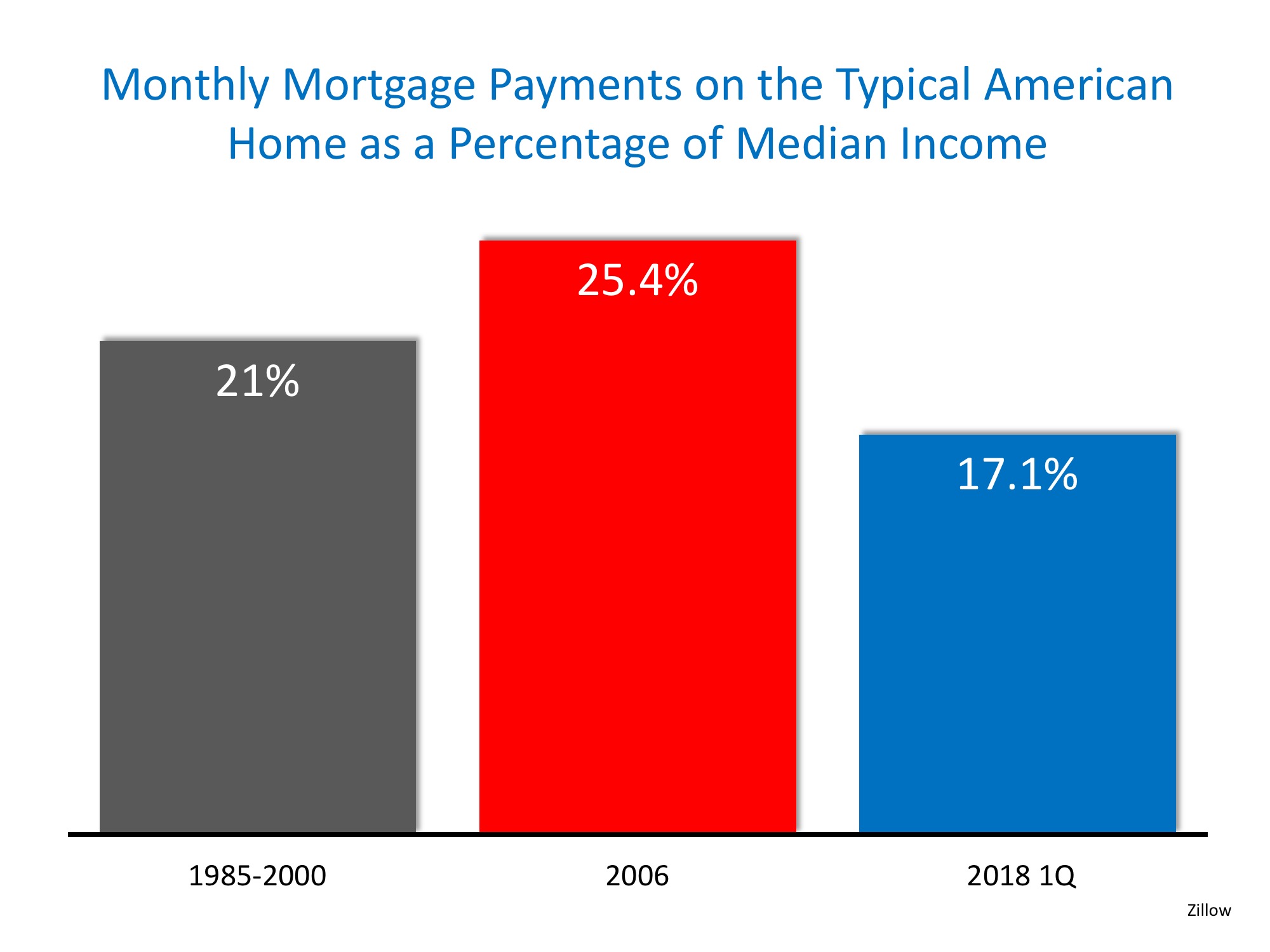

The interest rate that you secure for your mortgage is a big factor in your monthly housing cost and in how much you ultimately pay for your home. According to Freddie Mac’s Primary Mortgage Market Survey, rates rose to 4.62% on a 30-year fixed rate loan last week.

The Federal Reserve also raised the federal funds rate for the second time this year. If unemployment continues to be at or near record lows, two more hikes are likely to come later this year.

Nahas added,

“Rising rates can be good and bad for the economy. Bad for borrowing money with additional costs, but good to control inflation and help grow the economy at a moderate pace.”

Bottom Line

If you are planning on buying and/or selling a home this year, let’s get together to help you navigate the conditions in your market and set you up for success.

![Cost Across Time [INFOGRAPHIC] | Simplifying The Market](http://files.simplifyingthemarket.com/wp-content/uploads/2018/07/03135850/20180706-Share-STM.jpg)

![Cost Across Time [INFOGRAPHIC] | Simplifying The Market](http://files.simplifyingthemarket.com/wp-content/uploads/2018/07/03135755/20180706-STM-ENG.jpg)

![5 Reasons Millennials Choose to Buy a Home [INFOGRAPHIC] | Simplifying The Market](http://files.simplifyingthemarket.com/wp-content/uploads/2018/06/26162117/20180629-STM-ENG.jpg)

![4 Reasons to Sell This Summer [INFOGRAPHIC] | Simplifying The Market](http://files.simplifyingthemarket.com/wp-content/uploads/2018/06/21133003/4-Reasons-To-Sell-Summer-ENG-STM.jpg)

![Top 4 Home Renovations for Max ROI [INFOGRAPHIC] | Simplifying The Market](http://files.simplifyingthemarket.com/wp-content/uploads/2018/06/04152652/20180615-Share-STM.jpg)

![Top 4 Home Renovations for Max ROI [INFOGRAPHIC] | Simplifying The Market](http://files.simplifyingthemarket.com/wp-content/uploads/2018/06/04152632/20180615-Renovations-STM.jpg)

![The Cost of Renting vs. Buying [INFOGRAPHIC] | Simplifying The Market](http://files.simplifyingthemarket.com/wp-content/uploads/2018/06/06102703/20180608-Share-STM.jpg)

![The Cost of Renting vs. Buying [INFOGRAPHIC] | Simplifying The Market](http://files.simplifyingthemarket.com/wp-content/uploads/2018/06/06102642/Rent-vs.-Buy-STM.jpg)